Consumers aim to see the business performance over time so they pull up stock market charts once they start investing in stocks. Are these charts beneficial?

In reality, stock market charts don’t offer any benefit to those who utilize a buy-and-hold strategy. There are just a few situations when these charts bring value.

Keep on reading to find out reasons whether stock market charts are helpful for you.

Why Should You Use Stock Charts?

Many consumers think about starting the investing journey when they have issues with their funds.

Do you seek a 500 loan bad credit to cover immediate expenses? Do you have trouble building your emergency fund? Becoming an investor may help you finally reach financial freedom and security.

A valuable skill you can learn is the ability to read stock market charts.

What makes these charts useful and valuable? It’s necessary to admit that fund managers respond to 80 percent of all trading activity in this sphere.

The stocks increase and lower through selling and buying. If you are at the beginning of this road, you should avoid those stocks that are selling aggressively. This is where stock market charts come in handy.

As soon as you realize what you should seek, the charts will demonstrate to you the actions of these large investors.

This way, they will help you understand the times of heavy selling and buying that you should watch for.

This data can be used wisely to determine the most suitable time for selling or purchasing your stock positions.

Other Benefits of Stock Market Charts

Some consumers consider stock market charts to be too technical but it’s just a representation of shifts in trading volume and share price.

You shouldn’t be scared of them. Stock market charts can do you a favor and tell a real story of what is happening within the stock.

These charts can provide answers to these questions:

- How did large investors react to news concerning the stock market? Did they purchase more shares despite the bad news? Did they sell despite the good news?

- Do the managers purchase with enthusiasm? Do they tend to unload the shares quickly?

- Despite prior price reduction, did the investors support stock and buy more shares?

Have you filed your taxes? You can check the status of your tax return and whether the IRS obtained it. This platform can help you understand the reason your tax refund is lower than you supposed.

Apart from an online tool, you may check the status of your refund using the IRS2Go mobile app.

The Drawbacks of Stock Market Charts

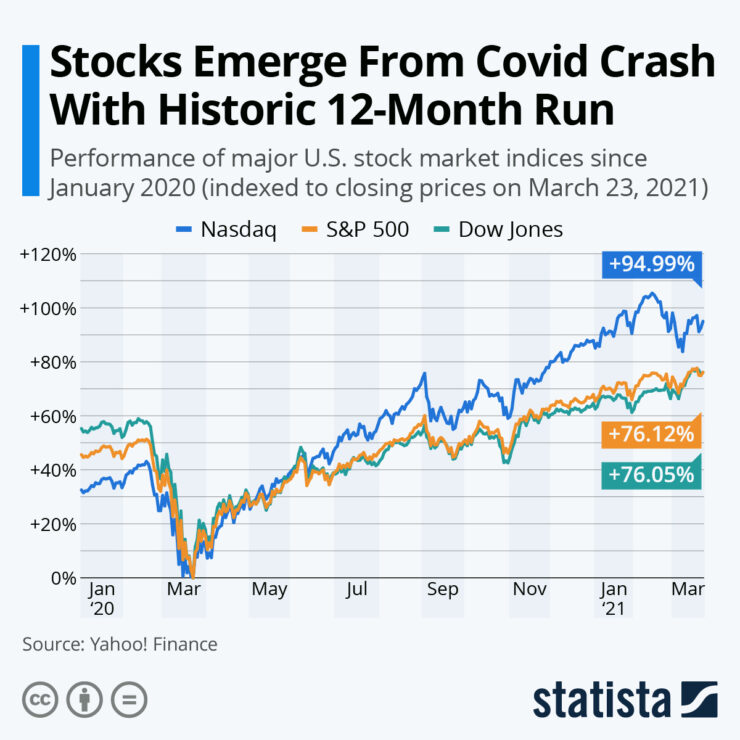

According to Statista, the stock market has risen over the past 12 months despite the global pandemic, a tough economic crisis, and historically high rates of unemployment.

The main reason for it was that large companies like Microsoft, Amazon, and Apple profited from the pandemic fallout.

Besides, the historic fiscal stimulus not just curbed the fall in consumer spending, but also left many investors unaffected by the pandemic and ready to invest in the stock market.

In reality, stock market charts don’t bring benefits for those who are long-term investors. In reality, you may see a big difference between the promised and the real total return.

Typically, it depends on many factors. There are some reasons why this happens.

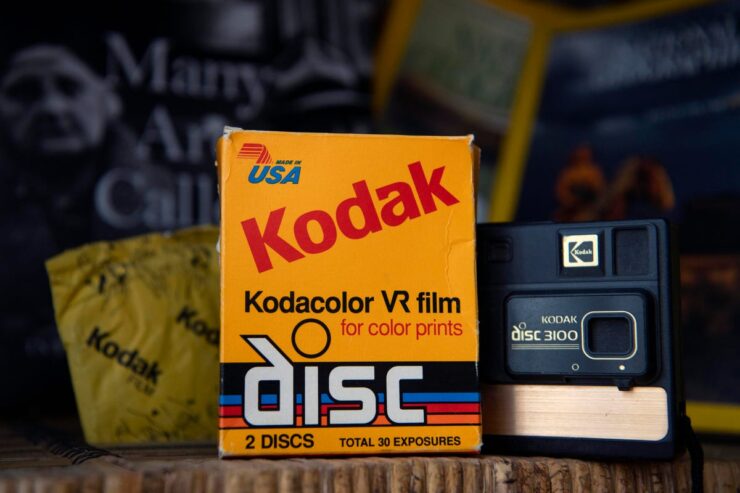

1. The Situation with Eastman Kodak

Eastman Kodak is one of the best examples. Everyone knows this film and camera company. In 2013, this organization rose after bankruptcy, and the funds its shareholders had invested in the stock were lost.

Imagine the situation in which you bought $50,000 of shares of this company 25 years ago. This stock was one of the most promising at the time.

Your investment would have increased to about $225,000 during this period. You would have obtained this sum even though this stock got wiped out eventually.

2. The Situation with Taxes, Deflation, and Inflation

Taxes are really important. Depending on where you place your asset, the net worth from the same investment over the same period may vary. A combination of a Roth IRA and a 401(k) would be perfect.

Deflation and inflation also miss securities as purchasing power is significant. For instance, during the economic downturn of 1929 stock losses led to a decrease in dollars.

3. The Situation with Dividends

Some ventures pay out a portion of their income as cash dividends. Larger enterprises can boost their profit quicker than the inflation rates. As a result, dividends can also expand. It offers investors a thought of how important these dividend payments are in comparison with the sum they had to use for share purchase.

4. The Situation with Spin-Offs

Every stock investor benefits from getting shares from a tax-free spin-off. Current shareholders will be typically given stock.

The reason for that is that this division fails to suit the mission’s needs. Thus, it can also be conducted by a company to take away regulatory oversight concentrated on this division.

Sometimes, the new public organization becomes more prosperous than the other one. A spin-off is beneficial as it provides shares in a new venture.

Generally, the investors won’t receive the taxable capital gain. Do you need more examples? Yum! A brand is a great sample. This is the parent company of KFC, Taco Bell, as well as Pizza Hut. In 1997, this company was allocated by PepsiCo.

PepsiCo may occur to be lagging behind Coca-Cola on a stock market chart for several decades.

However, if you take into account the Yum! post-election performance, the two large companies are almost on the scoresheet.

5. The Situation with Costs

Expenses matter especially when you plan to expand the fortune of your family. Every dollar you spend could go toward increasing your compound interest.

If you used to pay $100 to a broker for the execution of a stock trade, your expenses were high in comparison with the value of the assets you had.

The difference in stock buying performance cannot be reflected on stock charts.

The Bottom Line

Summing up, stock market charts may bring some value to investors. However, there are certain occasions when these charts aren’t sources of useful information.

Besides, they aren’t helpful for those who utilize a buy-and-hold strategy.