Businesses today must manage transactions efficiently. For companies that want to accept online payments, using a solution that provides flexibility and control is crucial. One option that many businesses explore is a white label payment gateway.

What Is a White Label Payment Gateway?

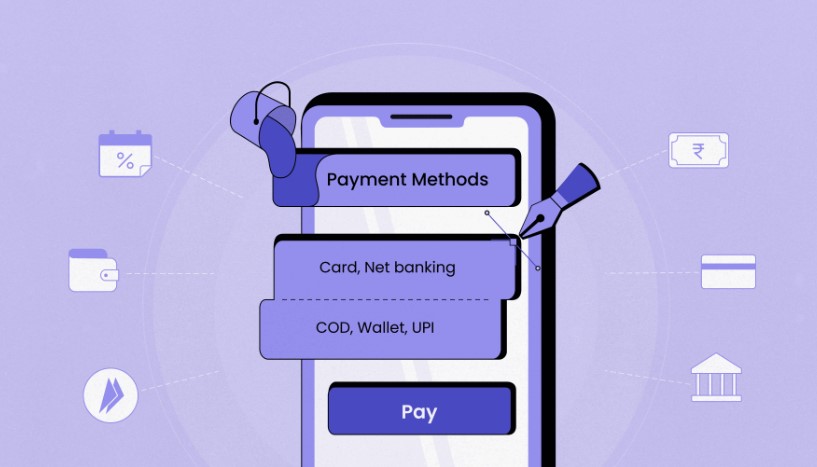

A white label payment gateway allows businesses to accept payments under their own branding. Rather than creating a payment system from scratch, businesses use a ready-made platform provided by another company. However, it appears to customers as if the company itself designed and developed the service.

White label solutions are typically offered by third-party providers. These providers handle the technical aspects, compliance requirements, and infrastructure maintenance. Businesses can then customize the interface, logo, and other visual elements, giving the impression that it is their own proprietary payment platform.

Benefits and advantages

White Label Payment Services provide many advantages. The most significant benefit is control over branding. With a white label platform, companies can build trust and loyalty by offering a seamless and consistent brand experience. Customers see the company’s branding throughout the entire transaction process, from checkout to payment confirmation.

Another key advantage is the ability to focus on core operations without worrying about complex payment infrastructure. With white label solutions, businesses do not need to manage technical aspects, security protocols, or compliance. Everything is handled by the provider. This frees up resources for product development and customer service.

Cost Savings

Building a payment platform from scratch involves significant time and financial investment. It requires hiring developers, designing user interfaces, and ensuring that security measures are in place. In contrast, using a white label platform reduces these expenses. The solution is already developed and ready for use. You can customize the appearance and functionality, but the core payment system remains unchanged.

In addition, many white label solutions offer flexible pricing models. Some providers charge a flat fee, while others use a transaction-based model. This gives businesses control over costs and ensures that they only pay for what they use.

Customization Options

The ability to tailor the platform to meet specific needs is a valuable feature. A white label gateway allows companies to create a user experience that reflects their brand identity.

The customization options often include the look and feel of the user interface. Businesses can change color schemes, logos, and fonts to align with their brand guidelines. Beyond visual aspects, companies can also customize features like payment methods and reporting tools. This flexibility allows businesses to provide an experience that feels unique to them.

Enhanced Security

Security is a top priority when dealing with financial transactions. A white label gateway provider takes care of compliance and security protocols. This ensures that all transactions meet the necessary standards. By using a white label solution, businesses benefit from the security infrastructure already in place. The provider handles encryption, data storage, and fraud detection. This minimizes the risk of security breaches.

Additionally, customers feel more confident when the payment experience is seamless and branded. They trust businesses more when transactions appear to be handled in-house, especially when the process is secure and efficient.

Time to Market

Developing a payment platform from scratch can take months or even years. With a white label gateway, the solution is ready to launch in a fraction of the time. Businesses can start accepting payments within days or weeks, depending on the level of customization required.

This quick setup gives businesses an edge in competitive markets. They can focus on growth, knowing that the payment system is reliable and efficient. Fast implementation also means businesses can respond quickly to new opportunities.

Global Reach

Many white label solutions support multiple currencies and languages. This opens the door to global markets. A business can offer customers the option to pay in their preferred currency, making it easier to close sales with international clients.

In addition, providers often have partnerships with local banks and payment processors. This simplifies the process of accepting payments from different countries. Businesses can expand globally without needing to negotiate contracts with multiple financial institutions.

Scalability and Flexibility

One of the main reasons businesses choose white label gateways is the ability to scale. As transaction volumes grow, the platform adjusts to handle the increased demand. Businesses do not need to invest in new servers or hire additional technical staff. The provider takes care of scaling the infrastructure.

Flexibility is another significant benefit. Businesses can add or remove features as their needs change. If a company wants to integrate a new payment method or reporting tool, it can do so without disrupting operations. This flexibility allows businesses to stay agile and adapt to market trends.

Customer Support

Most white label gateway providers offer robust customer support. This can be a significant advantage for businesses that lack technical expertise. When issues arise, the provider’s support team is available to assist with troubleshooting and technical questions.

This level of support ensures that businesses can maintain a smooth transaction process. Any downtime or disruption can lead to lost sales and frustrated customers. With dedicated support, businesses can resolve issues quickly and maintain customer satisfaction.

Compliance and Regulations

Regulatory compliance is a complex and ever-changing landscape. Businesses must ensure that their payment systems meet local and international regulations. A white label gateway provider manages compliance on behalf of the business.

Providers stay up to date with the latest regulations and industry standards. This includes PCI-DSS compliance, anti-fraud measures, and data protection regulations. By using a white label solution, businesses can ensure that they remain compliant without needing to invest in legal and technical expertise.

Competitive Edge

White label gateways offer businesses a competitive advantage. By providing a branded and seamless experience, companies can differentiate themselves from competitors. Customers appreciate a smooth and professional payment process. It enhances trust and encourages repeat business.

Businesses that offer a unique and branded experience can build stronger relationships with their customers. This leads to higher customer loyalty and long-term growth. In competitive industries, offering a white label payment solution can be the key to standing out.

Conclusion

A white label payment gateway offers businesses control, flexibility, and cost savings. With the ability to customize the platform, companies can provide a seamless and branded experience. Security, compliance, and scalability are all managed by the provider. Businesses benefit from a fast setup, global reach, and reliable customer support.

For businesses looking to grow and enhance their transaction process, a white label gateway can be a smart choice. By using a ready-made solution that can be tailored to specific needs, companies can focus on what matters most: serving customers and growing their business.

Related Posts:

- 20 Best Gaming Headset Under 50$ 2024 - for PC, PS4,…

- 12 Best Car Wax For Black Cars 2024 - Protection and…

- Top 10 Best Outdoor Basketball Shoes 2024 - Durable…

- Top 10 Best Paint Sprayer For Cabinets 2024 -…

- Top 10 Best Office Chair Under 200 2024 - Ergonomic…

- Top 10 Best Power Inverter for Car 2024 - Keep Your…